ONE PHILOSOPHY, THREE WAYS TO INVEST

At Allan Gray, our highly focused investment approach lets us keep things simple, including offering our investors a choice of just three funds. Each fund lets you take advantage of our time-tested contrarian philosophy while giving you investment options that suit a variety of needs.

Our distinctive take on investing means that each of our funds brings something very different to your portfolio – investments that are often undervalued and overlooked but with the potential to increase in value in the long term. It is this approach that helps you earn the higher long-term returns that Allan Gray aims to deliver.

See below to choose the fund that could be right for you.

Equity Fund

Balanced Fund

Stable Fund

Going against human instinct and taking a contrarian approach to investing is not for everyone. It takes practice and commitment in your convictions. We use our fundamental research to uncover opportunities in areas that are overlooked or discarded by other investors. We wait for the right opportunity to buy and give investments time for their value to be realised, as practicing patience can be a distinct advantage over the long term. We bring this established investment philosophy to you through the Allan Gray Australia Equity Fund.

Incurs a performance fee plus a base fee.CLASS B

Incurs a higher performance fee with zero base fee

| NAV price | 1.7252 |

| Application price | 1.7287 |

| Redemption price | 1.7217 |

Download Fact Sheet

The Fund may suit you if:

You’re looking for the core of an Australian equities portfolio

With the Allan Gray Australia Equity Fund, you can set and forget. Our analyst team researches and monitors the shares to make investment decisions for you.

You want to diversify an Australian equities portfolio

Being contrarian, our Funds are unlike those of our peers, so you need to be comfortable holding an investment that looks and performs differently from the others in your portfolio. Not only does being contrarian bring the opportunity for outperformance, but because we choose shares that are often overlooked or discarded by other investors, the Fund can be an effective way to diversify and complement other funds in a portfolio.

You can invest for the long term

In a competitive market it is difficult to have an edge. Focusing on the long term and being patient is one of the few advantages that we believe will endure. Not many investors can be patient and wait for value to emerge, as they respond to pressure to generate ‘instant’ performance. Investors who share our long-term philosophy could be rewarded, as we look past the short-term noise and wait patiently for the value in our shares to be recognised by the market.

Features at a glance

|

|

| APIR code: |

| ETL0060AU |

| ASX mFund code: |

| AQY01 |

| Base fee: |

| 0.75% p.a |

| Performance fee: |

| 20% |

| Buy/sell spread: |

| 0.20%/0.20% |

| Distribution frequency: |

| Annual |

| Inception date: |

| 4 May 2006 |

| Minimum suggested time frame: |

| More than five years |

| Investment objective: |

| Contrarian. We believe that investing in undervalued shares and securities identified through fundamental research offers the potential for strong returns over the long term. |

| Asset Allocation: |

| We aim to be fully invested in Australian-listed equities at all times. |

To benefit from a time-tested, contrarian investment approach

As contrarian investors we go against current market trends, buying an investment when it’s undervalued in a less optimistic environment then selling it when the market recognises the share’s potential and it reprices. By investing for the long term, we look past the short-term market noise and wait patiently for a share’s value to improve. We believe bottom-up research is key to finding true value. We do not rely on macro forecasting or third parties. Rather, our team of analysts undertakes its own rigorous research into each individual company to find hidden value.

To increase outperformance potential by investing differently

If you invest in the same shares as the majority of investors at the same time, it is by definition almost impossible to outperform the market. We look to buy shares when others are selling, and sell when others are buying. This gives us an edge, as we can face less competition and pay a lower price for shares that are out of favour with the broader investment community.

To improve the opportunity of upside

Taking a contrarian approach can improve your chance of paying a lower price and therefore achieving a better-than-average return. By looking in unpopular areas of the market, we may find bargains, where excessive negative investor sentiment has created the opportunity to buy shares at a good price. Results don’t have to be exceptional for the Equity Fund’s investors to do well. For instance, when a share is priced for ‘very bad’ expectations and the outcome is only 'quite bad', the share price can rise considerably. The outcome just has to be better than expected.

To reduce the risk of permanent loss of capital

Conversely, when a share is priced for ‘fantastic expectations’ and the outcome is only ‘quite good’ the share price can fall considerably. Speculative overoptimism can drive share prices way above fair value, increasing the risk of paying inflated prices and potential permanent loss of capital. By investing independently of popular market sentiment, a contrarian approach can potentially help investors reduce the risk of overpaying.

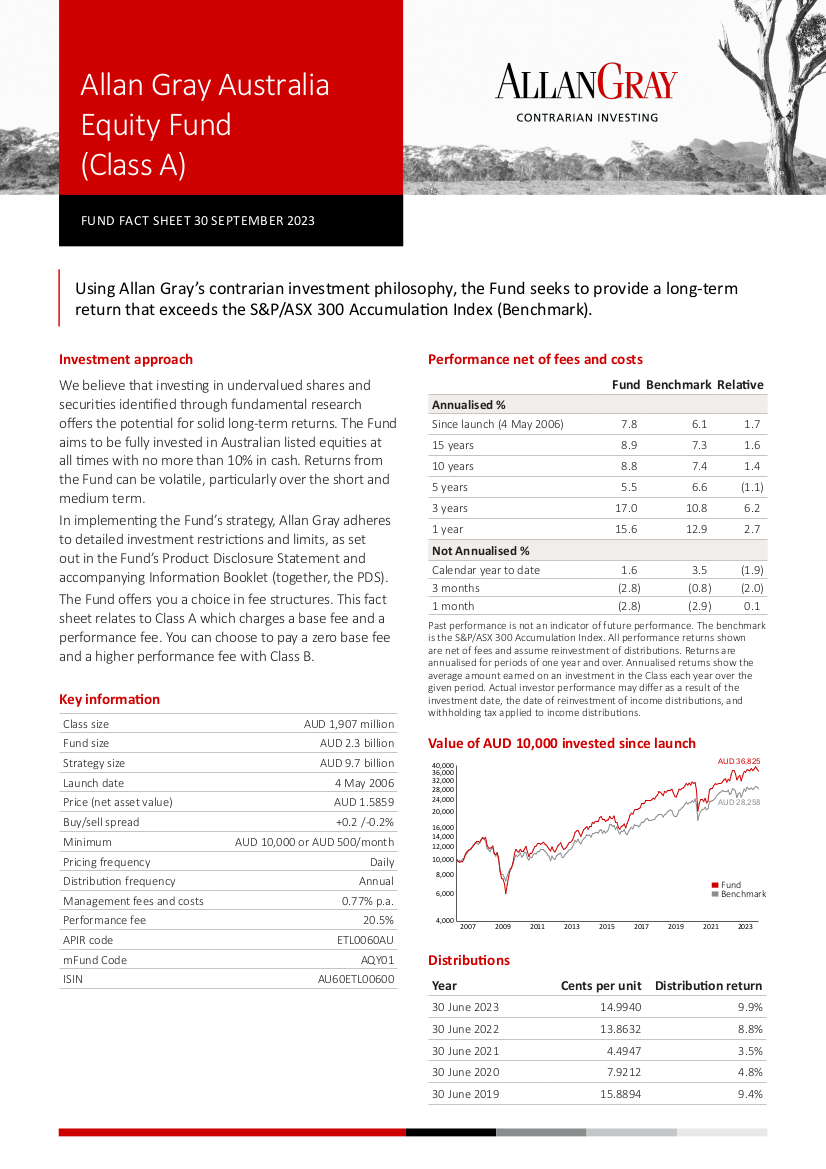

The chart shows the value of AUD 1000 invested in Class A units in the Fund and in the benchmark since public launch. Past performance is not indicative of future performance, The Fund's return assumes that distributions are reinvested and does not incorporate buy/sell spreads. The public launch date of the Fund was the 4 May 2006. The benchmark is the S&P/ASX 300 Accumulation Index. Fund prices will fluctuate and there is no guarantee with respect to the performance of the Fund or that an investor’s capital will be preserved. The actual performance experienced by investors may differ as a result of the specific investment date, the date of reinvestment of income distributions, and withholding tax applied to income distributions. The minimum initial lump sum investment amount is $10,000.

The Allan Gray Australia Equity Fund aims to seek long-term returns that are higher than the Benchmark - the S&P/ASX 300 Accumulation Index.

Our investment approach is contrarian. We believe that investing in undervalued shares and securities identified through fundamental research offers the potential for strong returns over the long term.

We aim to be fully invested in Australian-listed equities at all times, with no more than 10% in cash. You can learn more in the Fund’s Product Disclosure Statement and accompanying Information Booklet (together, the PDS).

RISKS OF INVESTING

All investments carry risk. If you are considering the Allan Gray Australia Equity Fund, you should be aware that:

There is no guarantee your investment will do well

We do not guarantee the success, repayment of capital or any rate of return on income, capital or investment performance of the Fund. Past performance is not necessarily an indicator of future performance.

Markets can be volatile

The Fund will primarily hold Australian shares. As these investments can be volatile, your investment will fluctuate.

Individual shares can and often do fall in value

Individual shares can fall in value for many reasons including a company’s internal operations, actions by its management, its business environment and investor sentiment and responses.

You can find a comprehensive explanation of the risks in the Product Disclosure Statement (PDS), which should be read together with the Information Booklet.

The Allan Gray philosophy has three main principles:

Contrarian

We take a contrarian approach to investing by avoiding popular trends and uncovering opportunities in areas that are overlooked or discarded by other investors.

Long-term

We take a long-term view. When we look for value we are willing to look through short-term bad news that may be affecting the share price and wait for an investment’s true value to be realised. In a competitive market, practicing patience can give you a distinct advantage.

Fundamental

We concentrate on understanding an investment’s core value and the fundamental factors that determine this, rather than trying to forecast the next share price move.

As an investor of Class A units in the Fund, you will pay a base fee of 0.75% p.a. and a performance fee of 20%. Class B units charge no base fee, but there is a performance fee of 35% of any outperformance. These fees are already included in the daily unit price for the Fund.

If after deducting the base fee (if applicable), the Fund’s return is higher than the benchmark’s return, then a performance fee is charged on the excess return. A high water mark is in place to ensure that you only pay once for performance which exceeds the benchmark.

HISTORY OF INDIRECT COST RATIOS

The indirect cost ratio, also known as the total expense ratio, is a measure of the actual expenses (including fees) incurred by the Fund over a 12-month period expressed as a percentage of the average daily value of the Fund for the same period. Performance is shown after taking into account expenses included in the ICR. Expenses may vary and the current ICR should not be used as an indication of future ICRs.

| Financial Year | Indirect Cost Ratios |

|---|---|

| 30 June 2021 | 0.77% |

| 30 June 2022 | 0.77% |

| 30 June 2023 | 0.77% |

Downloads

To achieve returns that exceed inflation over time, you should be invested in growth assets – a strategy that’s not always easy, especially during periods of market volatility. Designed to leverage our contrarian approach, the Allan Gray Australia Balanced Fund combines the performance potential you’re looking for with the ability to go against market consensus, giving you the flexibility you need to drive results.

| NAV price | 1.3384 |

| Application price | 1.3411 |

| Redemption price | 1.3357 |

Download Fact Sheet

The Fund may suit you if:

You want to diversify your portfolio within a single fund.

The Fund can be used as a cost-effective total portfolio solution. You can set and forget, knowing our team is constantly monitoring it (on an individual stock and security level as well as the asset class level) and has the freedom to move when opportunities become apparent.

You want lower risk than full exposure to the share market.

The Fund offers a strategy whereby the exposure to shares increases and decreases in line with our portfolio managers’ view of the share market. Essentially, you can invest in shares while reducing risk within the one fund.

You can invest for at least three years and withstand some market volatility.

You can start your investment with a minimum of $10,000 or as little as $500 per month in a regular savings plan.

Features at a glance

| APIR code: |

| ETL4654AU |

| ASX mFund code: |

| AQY03 |

| Management costs: |

| Base fee of 0.75% p.a. plus performance fee |

| Buy/sell spread: |

| 0.20%/0.20% |

| Distribution frequency: |

| Annual |

| Inception date: |

| 1 March 2017 |

| Minimum suggested time frame: |

| More than three years |

| Investment philosophy: |

| Contrarian. We believe that investing in undervalued shares and securities identified through fundamental research offers the potential for strong returns over the long term. |

| Global/Australian allocation |

|

Generally 60% Australian / 40% Global

When there are fewer opportunities in Australia or global markets become more attractive, the Fund may become more heavily weighted towards global assets and vice versa.

|

| Asset class allocation: |

|

The fund has the ability to take advantage of market movements with wide ranges for investment. The fund does not have industrial or market sector investment targets, however it is anticipated that the Fund portfolio will hold:

40-90% in equities

10-50% in fixed income and cash

0-10% in commodity-linked instruments

|

|

Global/Australian Allocation

Generally: 60% Australian/ 40% global When there are fewer opportunities in Australia or global markets become more attractive, the Fund may become more heavily weighted towards global assets and vice versa. |

||||||||||||||

Asset class allocation

The fund has the ability to take advantage of market movements with wide ranges for investment. The fund does not have industrial or market sector investment targets, however it is anticipated that the Fund portfolio will hold: 40-90% in equities

10-50% in fixed income and cash 0-10% in commodity-linked instruments |

Performance driven with the flexibility to adapt

While the Fund offers a broad investment mix to balance risk, its focus is to drive performance, as it is long-term returns that grow wealth. We can vary its

exposure to different asset classes depending on where we find value, the potential for capital growth and income, and risk of loss. This flexibility helps us

drive long-term returns while seeking to reduce the impact of major market falls.

Time-tested contrarian investment philosophy

Going against human instinct and taking a contrarian approach to investing is not for everyone. It takes true discipline and commitment in your convictions.

Allan Gray Australia and Orbis Investments were both founded by Dr Allan Gray and share the same investment philosophy that the group has used for over

45 years. Our long-term results speak for themselves.

Better returns require a strong foundation

To reduce risk and generate higher long-term returns we aim to buy the right assets at the right price. Prioritising our long-term view in our fundamental

analysis gives us a competitive edge that allows us to deliver better outcomes. We focus on understanding an asset’s underlying intrinsic value, the drivers

that determine this, and the gap between this value and the price you can buy it for.

Global expertise in managing balanced portfolios

Since 1999, Allan Gray in South Africa has been successfully managing balanced portfolios, which we brought to the Australian market with the launch of

the Allan Gray Australia Balanced Fund in 2017. This Fund combines Allan Gray Australia’s domestic specialisation with Orbis Investment’s global markets

expertise.

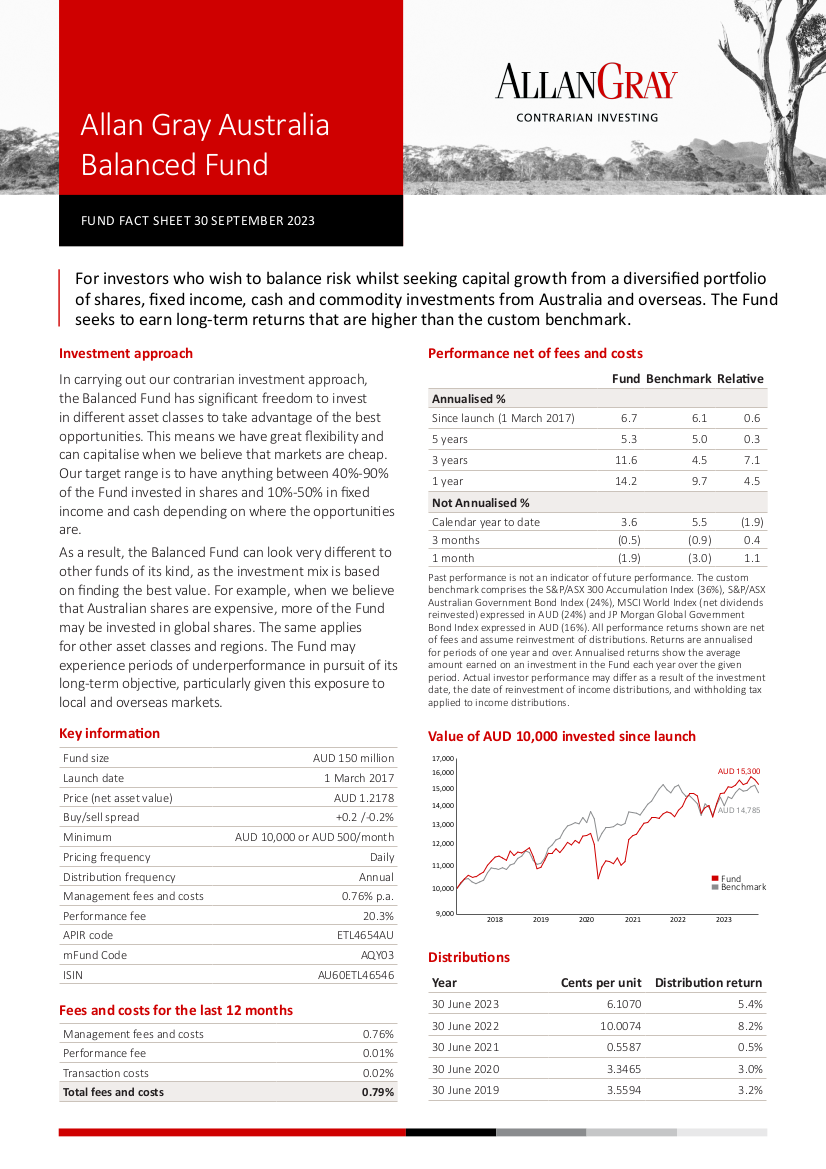

The chart shows the value of AUD 1000 invested in the Fund and in the benchmark since public launch which was 1 March 2017. Returns are net of fees, include income, assume reinvestment of distributions and exclude any spreads that might be payable on transactions. Fund prices will fluctuate and there is no guarantee with respect to the performance of the Fund or that an investor's capital will be preserved. The actual performance experienced by investors may differ as a result of the specific investment date, the date of reinvestment of income distributions, and withholding tax applied to income distributions. Past performance is not indicative of future performance. The minimum initial lump sum investment amount is $10,000.

The Fund uses a custom benchmark consisting of:

- 36% S&P/ASX 300 Accumulation Index

- 24% S&P/ASX Australian Government Bond Index

- 24% MSCI World Index (net dividends reinvested) in AUD

- 16% JP Morgan Global Government Bond Index in AUD

The Fund invests in shares, fixed income, commodity investments and cash using our contrarian, long-term and fundamental investment philosophy.

Generally, around 60% of the Fund’s portfolio will be invested in Australian investments, with the remainder in international investments. When Australian investments are more attractive, the Fund may invest more in Australia – or vice versa. The Orbis Group will manage the international component of the Fund. (Orbis is Allan Gray’s sister company and has successfully managed global equities for 25 years. Like Allan Gray, the Orbis Group was founded by Dr Allan Gray and shares the same investment philosophy.)

Allan Gray and the Orbis Group will actively select shares and corporate bonds where we think that they offer value and/or their income potential is better than the Fund’s benchmark. The Fund may also invest in Government bonds, cash or indirectly in commodities like gold through commodity-linked instruments.

While the Fund has no market sector investment targets, it’s expected to hold:

- 40-90% of its portfolio in shares

- 10-50% of its portfolio in fixed income and cash

- 0-10% of its portfolio in commodity-linked investments

From time to time, the Fund may move outside these ranges to pursue its objective. The range is very broad and the Fund flexible, enabling us to take advantage of opportunities when they arise and meaning the Fund could look quite different from its peers.

RISKS OF INVESTING

All investments carry risk. If you are considering the Allan Gray Australia Balanced Fund, you should be aware that:

There is no guarantee your investment will do well

We do not guarantee the success, repayment of capital or any rate of return on income, capital or investment performance of the Fund. Past

performance is not necessarily an indicator of future performance.

Markets can be volatile

The Fund will primarily hold Australian and international shares and bonds. As these markets can be volatile, your investment may fluctuate. In addition,

some of the markets in which the Fund invests may be considered emerging markets, which carry their own risks such as political and social instability.

Currency movements will impact performance

Although a large portion of the Fund will be held in Australian assets, fluctuations in exchange rates can have a significant influence on the Fund’s

international investments and could impact overall returns.

You can find a comprehensive explanation of the risks in the Product Disclosure Statement (PDS), which should be read together with the Information Booklet.

The Allan Gray philosophy has three main principles:

Long-term

We take a long-term view. When we look for value we are willing to look through short-term bad news that may be affecting the share price and wait for

an investment’s true value to be realised. In a competitive market, practicing patience can give you a distinct advantage.

Contrarian

We take a contrarian approach to investing by avoiding popular trends and uncovering opportunities in areas where others aren’t looking.

Fundamental

We concentrate on understanding an investment’s core value, and the fundamental factors that determine this, rather than trying to forecast the next

share price move.

We determine the Fund's holdings within each asset class based on where we find the best value. We won’t buy a share or bond simply because it’s part of the Fund’s custom benchmark – it has to offer value and we only invest if we believe it will increase the Fund’s overall return. We will not buy a commodity-linked investment if a share or bond can provide exposure to the same underlying commodity more attractively.

As an investor in the Fund, you will pay a base fee of 0.75% p.a. and a performance fee of 20%. These fees are already included in the daily unit price for the Fund.

If after deducting the base fee (if applicable), the Fund’s return is higher than the benchmark’s return, then a performance fee is charged on the excess return. A high water mark is in place to ensure that you only pay once for performance which exceeds the benchmark.

HISTORY OF INDIRECT COST RATIOS

The indirect cost ratio, also known as the total expense ratio, is a measure of the actual expenses (including fees) incurred by the Fund over a 12-month period expressed as a percentage of the average daily value of the Fund for the same period. Performance is shown after taking into account expenses included in the ICR. Expenses may vary and the current ICR should not be used as an indication of future ICRs.

| Financial Year | Indirect Cost Ratios |

|---|---|

| 30 June 2021 | 0.78% |

| 30 June 2022 | 0.78% |

| 30 June 2023 | 0.79% |

Downloads

To meaningfully outperform cash, you need to be invested in growth assets, but some investors don’t want the volatility that could come with full exposure to the share market. That's where the Allan Gray Australia Stable Fund can help. The Fund aims to outperform the Reserve Bank of Australia cash rate over the long term by investing predominantly in cash and money market instruments, but can boost returns by investing no more than 50% in Australian-listed securities. Rather than holding complicated investments, it's simply a cash-heavy fund that invests in listed securities, like shares, when we believe the opportunity is right.

| NAV price | 1.2056 |

| Application price | 1.2068 |

| Redemption price | 1.2044 |

Download Fact Sheet

The Fund may suit you if:

You're looking for a simple alternative to cash with potential for better returns

You want to preserve your purchasing power but wish to generate more returns than cash offers without full sharemarket exposure. The Fund’s cash-plus objective and limited exposure to shares aims to outperform cash over the long term.

You're a conservative investor wanting some stability

Although you want potentially higher returns than cash, you’re averse to losing capital. The Fund gives you exposure to the market without being fully invested by limiting your exposure to shares to 50% of its assets. The Fund also helps you by investing in shares when they have fallen and there is better value in the market. This strategy can reduce risk, while increasing potential returns as share prices rise.

You have a two-year-plus timeframe

The Fund can be used with a two-year-plus view and potentially earn greater returns than pure cash.

You want to supplement your income

You're in the pension phase ready to drawdown and are looking to supplement your income.

Features at a glance

| APIR code: | ETL0273AU |

| Base fee: | 0.25% p.a. |

| Performance fee: | 20% |

| Buy/sell spread: | 0.10%/0.10% |

| Distribution frequency: | Quarterly |

| Inception date: | 1 July 2011 |

| Minimum suggested time frame: | Two years or longer. |

| Investment objective: | The Fund aims to provide a long-term return that exceeds the Benchmark, with less volatility than the Australian sharemarket. |

| Investment approach: | The Fund invests a minimum of 50% in cash and money market instruments such as term deposits. When the opportunity arises, the remainder is invested in carefully selected Australian securities using our contrarian investment philosophy. When Allan Gray believes sharemarkets offer compelling long-term value, up to 50% of the Fund’s total assets may be held in Australian-listed securities. |

| APIR code: |

| ETL0273AU |

| ASX mFund code: |

| AQY02 |

| Base fee: |

| 0.25% p.a. |

| Performance fee: |

| 20% |

| Buy/sell spread: |

| 0.10%/0.10% |

| Distribution frequency: |

| Quarterly |

| Inception date: |

| 1 July 2011 |

| Minimum suggested time frame: |

| Two years or longer. |

| Investment objective: |

| The Fund aims to provide a long-term return that exceeds the Benchmark, with less volatility than the Australian sharemarket. |

| Investment approach: |

| The Fund invests a minimum of 50% in cash and money market instruments such as term deposits. When the opportunity arises, the remainder is invested in carefully selected Australian securities using our contrarian investment philosophy. When Allan Gray believes sharemarkets offer compelling long-term value, up to 50% of the Fund’s total assets may be held in Australian-listed securities. |

To access sharemarkets with lower risk

We strongly believe investors need to be invested in shares for the best long-term returns, but not everyone is comfortable with the volatility this can bring. By investing predominantly in cash with selected exposure to the sharemarket, the Fund enables clients to potentially outperform cash with less risk than investing in the sharemarket alone. Exposure to shares will never exceed 50% of the portfolio and has historically averaged 30% since the Fund’s inception.

To outperform cash without too much complexity

We don't believe that beating cash should be complicated. This is why the Fund does not employ complex strategies such as long/short trading, options or derivatives. It simply invests in cash, term deposits and money market instruments and has limited exposure to selected domestic securities, like shares.

Time-tested contrarian investment philosophy

Our investment philosophy is simple – we take a contrarian approach, apply it consistently and invest for the long term. To give investors the benefit of this approach, our Stable Fund still incorporates our contrarian share ideas that we use in our Equity Fund while prioritising our long-term fundamental analysis.

If you are looking for a low-volatility fund

The Fund traditionally has lower volatility than other funds offering equity exposure because it is predominantly invested in cash and other money market instruments. While our selective exposure to shares gives investors the potential to generate higher returns than cash , the Fund has much less volatility than a pure equity fund. Volatility is also reduced as a result of our contrarian approach, as its inherent countercyclical behaviour means we invest more in shares when we believe they are undervalued, then we reduce exposure as the market rises and we see less value. This helps to drive long-term real (above inflation) returns, while seeking to reduce the impact of major market falls.

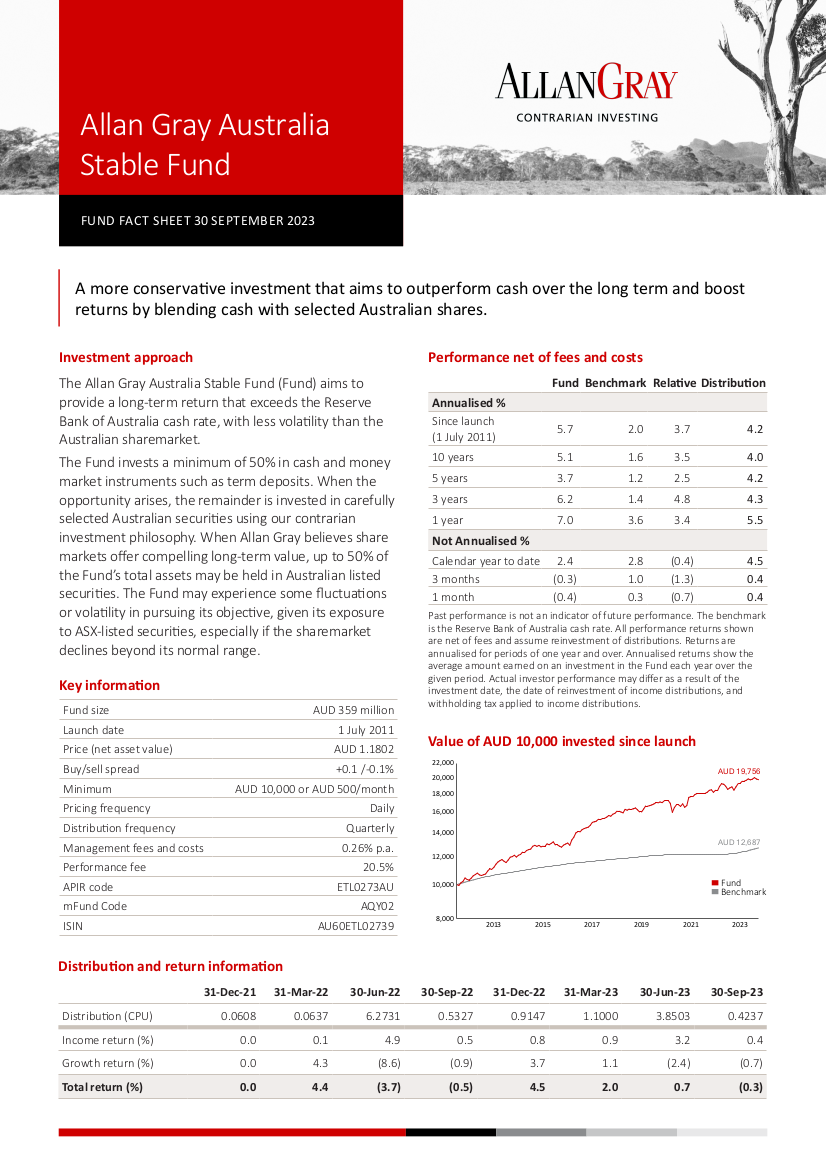

The chart shows the value of AUD 1000 invested in the Fund and in the benchmark since public launch. Past performance is not indicative of future performance. The Fund’s return assumes that distributions are reinvested and does not incorporate buy/sell spreads. The public launch date of the Fund was the 1 July 2011. The benchmark is the Reserve Bank of Australia cash rate. Fund prices will fluctuate and there is no guarantee with respect to the performance of the Fund or that an investor’s capital will be preserved. The actual performance experienced by investors may differ as a result of the specific investment date, the date of reinvestment of income distributions, and withholding tax applied to income distributions. The minimum initial lump sum investment amount is $10,000.

The Fund aims to provide a long-term return that exceeds the Benchmark, with less volatility than the Australian sharemarket.

The Fund invests a minimum of 50% in cash and money market instruments such as term deposits. When the opportunity arises, the remainder is invested in carefully selected Australian securities using our contrarian investment philosophy. When Allan Gray believes sharemarkets offer compelling long-term value, up to 50% of the Fund’s total assets may be held in Australian listed securities.

This portfolio flexibility helps us drive long-term returns while seeking to reduce the impact of major market falls. We want to help investors put their money to work at the most opportune time and reduce risk when the sharemarket is high and cheap investments are scarce.

In implementing the Fund’s strategy, Allan Gray adheres to detailed investment restrictions and limits, as set out in the Fund's Product Disclosure Statement , and accompanying Information Booklet.

RISKS OF INVESTING

All investments carry risk. If you are considering the Allan Gray Australia Stable Fund, you should be aware:

There is no guarantee your investment will perform well

Please remember that we do not guarantee the success, repayment of capital or any rate of return on income, capital or investment performance of the Fund. In particular, past performance is not necessarily an indicator of future performance.

While we limit the Fund’s money market investments to those that are high quality, credit risk exists

If an issuer defaults on an investment, the Fund may suffer a loss of capital, interest or delay in repayment of capital. The market value of an investment can also fall significantly when the perceived risk associated with it increases or its credit rating declines.

You can find a comprehensive explanation of the risks in our Product Disclosure Statement , which should be read together with the Information Booklet.

The Allan Gray investment philosophy has three main principles:

Long-term

We take a long-term view. When we look for value we are willing to look through short-term bad news that may be affecting the share price and wait for an investment’s true value to be realised. In a competitive market, practicing patience can give you a distinct advantage.

Contrarian

We take a contrarian approach to investing by avoiding popular trends and uncovering opportunities in areas where others aren’t looking.

Fundamental

We concentrate on understanding an investment's core value and the fundamental factors that determine this, rather than trying to forecast the next share price move.

As an investor in the Fund, you will pay a base fee of 0.25% p.a. and a performance fee of 20%. These fees are already included in the daily unit price for the Fund.

If after deducting the base fee (if applicable), the Fund’s return is higher than the benchmark’s return, then a performance fee is charged on the excess return. A high water mark is in place to ensure that you only pay once for performance which exceeds the benchmark.

HISTORY OF INDIRECT COST RATIOS

The indirect cost ratio, also known as the total expense ratio, is a measure of the actual expenses (including fees) incurred by the Fund over a 12-month period expressed as a percentage of the average daily value of the Fund for the same period. Performance is shown after taking into account expenses included in the ICR. Expenses may vary and the current ICR should not be used as an indication of future ICRs

| Financial Year | Indirect Cost Ratios |

|---|---|

| 30 June 2021 | 1.49% |

| 30 June 2022 | 1.78% |

| 30 June 2023 | 0.47% |