In this extract from the March 2020 Quarterly Commentary, Julian Morrison, CFA, National Key Account Manager reviews the performance of the Allan Gray Australia Funds. Click here to read the full Quarterly Commentary.

In this extract from the March 2020 Quarterly Commentary, Julian Morrison, CFA, National Key Account Manager reviews the performance of the Allan Gray Australia Funds. Click here to read the full Quarterly Commentary.

Allan Gray Australia Equity Fund

The Australian sharemarket fell heavily during the first quarter of 2020. After peaking in late February, fear regarding the impact of COVID-19 became panic, resulting in widespread and indiscriminate selling as described earlier in this report. The broad market, as measured by the S&P/ASX 300 Accumulation Index, fell 23.4% for the quarter.

The Allan Gray Australia Equity Fund underperformed its S&P/ASX 300 Accumulation Index benchmark by 10.1% for the quarter. The largest detractor from performance for the quarter was our overweight position in the Energy sector, which includes stocks such as Woodside Petroleum and Oil Search. Another large factor in the underperformance was the absence of Healthcare exposure. Healthcare was the strongest performing sector for the quarter, but one where we continue to believe valuation risk remains high in general and particularly versus other parts of the market.

Positive contribution to performance came from stock selection within the Consumer Staples sector, with Metcash performing very strongly against the broader market trend. Our lack of exposure to the Real Estate sector was also a positive factor as that sector fell heavily. Though as a result of falling prices, some stocks within that sector have started to look a lot more attractive. Looking through the current panic and indiscriminate selling, we believe the value potential inherent in our energy, gold and other contrarian exposures remains significant.

Allan Gray Australia Balanced Fund

The Allan Gray Australia Balanced Fund underperformed its composite benchmark by 9.0% in the first quarter of 2020. This was largely due to the underperformance of our equity holdings versus the benchmark equity exposure. On the positive side, the Fund’s exposure to gold contributed positively for the quarter. The Fund remains underweight Australian equities and overweight global equities at quarter end.

Around 23.6% of the portfolio is currently invested in fixed income. Here we remain significantly shorter in duration than the benchmark – at below two years versus seven years for the benchmark. This has detracted from relative performance for some time in an environment of falling interest rates, including during the last quarter. However the Fund remains more defensively positioned than the benchmark in terms of both relative and absolute returns, in the event interest rates rise.

Allan Gray Australia Stable Fund

The Allan Gray Australia Stable Fund underperformed its RBA cash rate benchmark by 7.3% during the quarter.

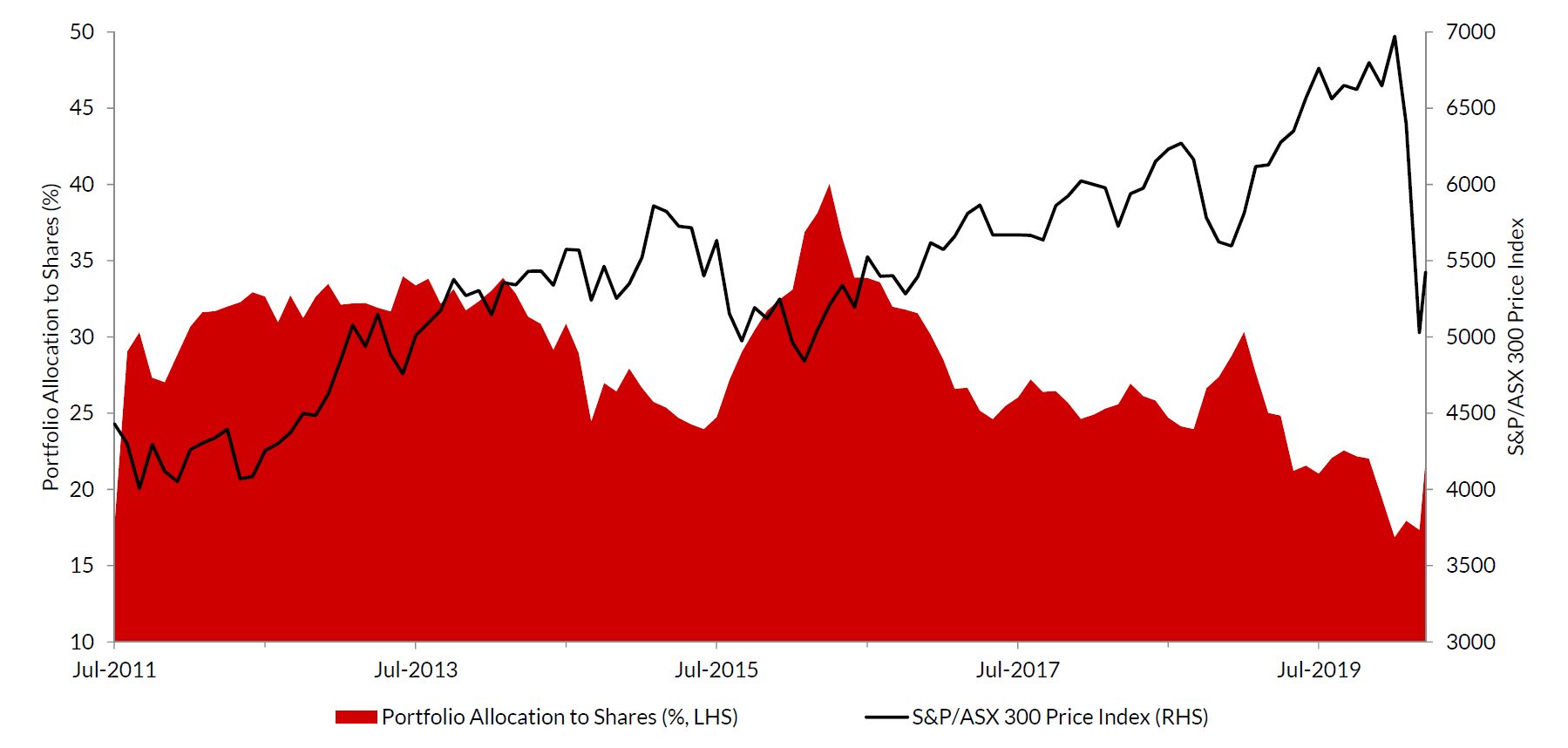

The performance of the Stable Fund is driven by the performance of our favoured Australian share holdings and the decision on how much is invested in shares versus cash. With sharemarkets falling heavily, the Fund also fell during the quarter, though far less than broader sharemarkets as it started the quarter with only 21.1% of its portfolio in shares. This was reduced further to 16.7% at around the time of the market peak in late February, with the remainder held in cash and term deposits.

With shares falling quite dramatically from that point, the Fund has added significantly to not only maintain that share allocation, but to raise it further to around 22.2% at the time of release of this report in mid-April (this can be seen in Graph 1, which shows our allocation between cash and equities over time). This has been done selectively, where we have seen the best value, and we continue to look for opportunities.

Graph 1: Stable Fund portfolio weightings – equity allocation rises where we see value in equities

Source: Allan Gray, Bloomberg, as at 15 April 2020

Julian Morrison holds a Bachelor of Arts (Honours – University of Sheffield) and the Chartered Financial Analyst designation.